A LETTER FROM THE CEO:

Dear Valued Members,

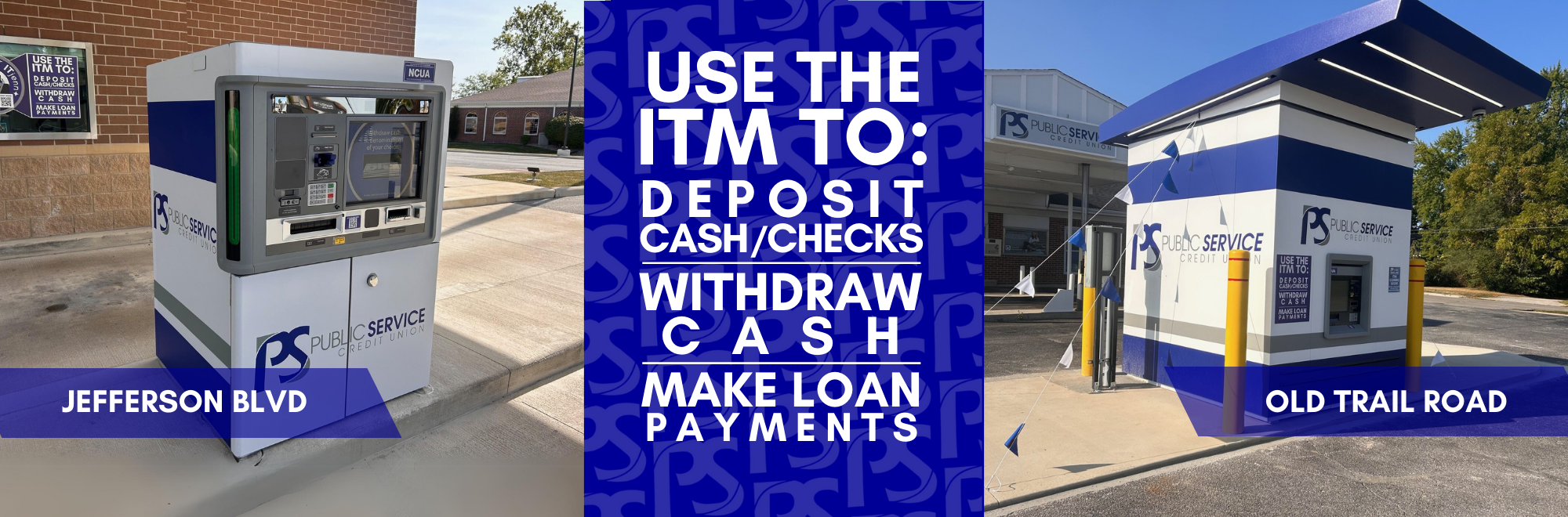

As I reflect on the past, I’m struck by how much banking has transformed. I remember waiting in the car in the late 1970’s, while my mom rushed to deposit her paycheck before the bank closed at 3 pm. Fast forward to today, and we’ve come a long way. Technology has revolutionized banking, making it easier, faster, and more convenient. With online banking, e-statements, bill pay, mobile apps, and deposit technology at our fingertips, we’ve streamlined our services. Our Interactive Teller Machines (ITMs) are the latest innovation, allowing you to deposit cash and checks, withdraw cash, make loan payments, transfer money, and more!

With this new technology, you may have concerns:

- Are tellers losing their jobs? No, they’re becoming Relationship Advisors. They’re learning more skills, and their wages are increasing as they take on more duties and responsibilities.

- Are we losing the personal touch? No, every member that walks through the door is greeted by the same staff, saying hello, chatting, and making sure their needs are taken care of!

At Public Service CU, we’re transforming the banking experience to be more collaborative and proactive. As you adapt to new technology, we’re adapting too. We’ve seen a decline in branch transactions, and our staff is evolving to focus on more complex, personalized services. Instead of waiting for you to reach out, we’re committed to actively monitoring your accounts and financial habits to identify opportunities to enhance your financial well-being.

You will receive a Relationship Advisor – someone who will work with you as your personal advisor. Most members use technology for their day-to-day banking, but when it comes to solving problems, they prefer to have a dedicated person to help them, this is the role of your advisor. Our goal is to anticipate your needs and provide personalized support, whether it’s boosting your savings, optimizing your loans and credit, or simplifying your banking experience through innovative technology. We’re dedicated to being your trusted financial partner, always looking out for your best interests and providing peace of mind wherever you are.

Meet our team of Relationship Advisors: Justin, Hannah, Jenn, Todd, Leisa, and Robbie. If you have an existing connection with any of them, kindly let us know and we’ll prioritize pairing you with that advisor. Please note that assigned advisors may take some time, but feel free to inquire via text, email, or during your next visit.

I’d like to share a remarkable story that underscores the power of adaptability and openness. Recently, a 92-year-old member walked into our Jefferson office, surrounded by unfamiliar changes. But what happened next was truly inspiring. Despite his initial hesitation, he bravely decided to tackle our new Interactive Teller Machine (ITM) with the guidance of a Relationship Advisor. As he completed his first transaction, a smile spread across his face. ‘Easier than I thought,’ he exclaimed, wondering why he had ever feared this technology. What’s even more remarkable? He returned another day to use the ITM again, confidently navigating it on his own, while having a friendly chat with his Relationship Advisor. This is a testament to the fact that age is not a barrier to learning and growth.

Now, it’s your turn! If you haven’t experienced our ITMs yet, I invite you to discover their convenience and innovation. Trust me, they’re COOL – and I’m not just saying that because I’m the President, they really are cool!

Welcome to the exciting changes ahead at Public Service Credit Union! We’re here to support you every step of the way. Your feedback and questions are valuable to us. Reach out anytime- call/text 260-432-3433 or email pscu@mypscu.com – we’re listening.

Sincerely,

Carolyn Mikesell, CUCE

Public Service CU, President